With the rise of the internet and exploding growth of the China e-commerce in the last 20 years. More and more foreign brands are becoming interested in selling their products directly into China using eCommerce platforms.

The challenge, however, is that China is not exactly a walk in the park for foreign brands. It has complex regulatory policies and vastly different eCommerce ecosystems. This is why, as a foreign brand who wants to sell to China using cross-border e-commerce trade it is critical to understand the latest market trend, political policies, and financial insights.

In this ultimate guide to Cross-Border eCommerce in China, we are going to walk you through all the necessary steps you’ll need to know as a foreign brand about selling to China and we’ll begin with a brief history of Cross-Border Ecommerce in China.

History of Cross-Border Ecommerce in China From 1.0 to 3.0, 20 Years in the Making

1.0 (1998-2007), The Rise of Oversea Buyers

-

1998As early as 1998 a selective few individual foreign trading company in China begin to explore the opportunity of selling across the border using the newly formed internet technology. A Good example of these company and is still operating today is goodorient.com, who sells and exports Chinese style clothing abroad.

-

1999Shortly a year after, Jack Ma founded the website Alibaba.com which is a business to business platform or portal that allows Chinese factories and manufacturers to directly sell their product to oversee companies.

-

2002 to 2003Giants eCommerce companies in the US begin to explore the growing market of China. This company includes eBay and Amazon.

-

2004Smaller wholesaler begins to export products directly to oversee buyers. For example, dhgate.com(敦煌网) allows foreign small business from many major countries across the world to purchase Chinese manufactory products in bulk. Unlike Alibaba, dhgate.com is not a listing platform, they handle the inventory and shipping of all products themselves.

-

2005 to 2007

With the wide acceptance of internet from all across the world and Steve Job introducing the very first iPhone in 2007. Many Chinese individuals who live a broad in countries such as England, United States and Canada begin to sell foreign goods back to friends and families with a small markup. These individuals are referred to as DaiGou (代购).

At an early stage, typical DaiGou will be international students who study abroad and flight attendant because of their traveling. As this industry progress, more and more professional d DaiGou started to sell their products on Chinese e-commerce platforms such as Taobao.com).

Until this day, tens of thousands of DaiGou will sell all kinds of product using popular channels such as WeChat. However, this model of eCommerce is in our opinion is only a temporary solution to bridge the growing demand of Chinese consumer and foreign product.

2.0 (2007-2013), The Age of International Purchasing

-

2007With the raise of DaiGou international eCommerce platform such as haitao.com begin to expand vertically both allowing foreign individuals (DaiGou) to sell across the border to other consumers in China.

-

2009With the raised of the Chinese consumer’s purchasing power companies such as ymatou.com(洋码头) begin to allow foreign manufactures to sell directly to Chinese buyers in China.

-

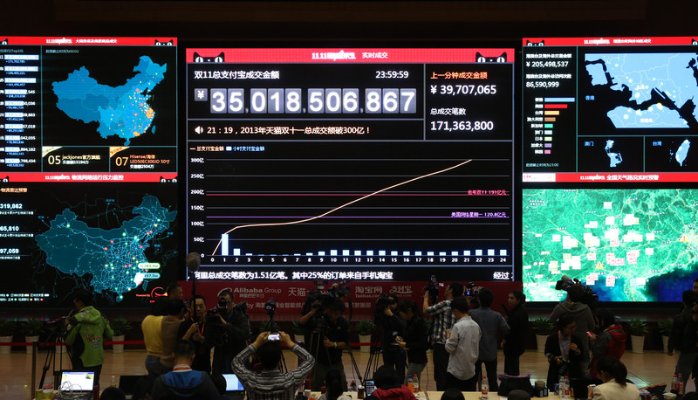

2013In 2013 dx.com(DealeXtreme) and lightinthebox.com(兰亭集势), two of the largest B2C Chinese eCommerce sites went IPO.

3.0 (2013-Present), The Boom

-

2013With the rapid adoption of smart phones, many cross-border e-commerce platforms such as wish.com begin to more and more Chinese consumers making purchases on their mobile.

-

2014 to 2015A new era of diversity was born in China. During these years there are more than 5,000 cross border e-commerce platforms startups, and these companies include (kaola.com) 考拉, (vip.com) 唯品会, (mia.com) 蜜芽, (xiaohongshu.com) 小红书.

-

2016With so many new platforms in the mix, wars and price wars begin to form in China among various cross border e-commerce platforms. And as new regulations and policies form in regards to foreign trade and cross-border e-commerce selling and buying, the industry might begin to experience turbulences in the coming years.

From 0 to $1 Trillion Market and On

It’s great to see a timeline of China’s cross border ecommerce and history, but it is meaning less to you as a business without showing you the impact it had for China’s e-commerce and even potentially on your business should you decided to sell to China. To do this let us closely examine the 4 aspects of where China’s cross border e-commerce currently stands.

Revenues

From 2014 till today, due to changes in cross border purchasing tariffs and improved overall policies on foreign trade, the number of platforms and users purchasing foreign good has exploded in China. On top of that, the fierce competition between the platforms has forced the large eCommerce brands to improve overall user experiences and quality of customer services into a new era in China.

According to iiMedia Research, cross border e-commerce trading which includes import and export has reached $945 billion USD in 2016 and it is estimated to reach $1.36 trillion USD by 2018. The importing market in 2016 (i.e. export to China) has hit 180 billion, which is a 20% share of the 2016 overall trading amount.

While cross border e-commerce is still a new player in China’s gigantic eCommerce market, it is, however, growing at a rapid path, and a huge opportunity in the years to come.

Market Share and Competitions

If we look at the market share as of today, we can really break up the cross-border e-commerce platform into three groups based on revenue.

Rank 1:

On the very top, you have some of the super star e-commerce brands in China that include kaola.com(网易考拉海购), Tmall.com(天猫国际), JD.com(京东全球购), vip.com(唯品国际). These brands take up the majority of market share running at 70.4%.

Furthermore, the brands in rank 1 are all e-commerce giants that already have a strong presence in China. They have loyal customers and extensive supports in many aspects such as logistics, and even customer support. For these companies, the oversea or cross-border markets are viewed as an expansion of their existing national business. They are oligopolies in this game.

Rank 2:

In rank 2 we have brands such as jumeiglobal.com(聚美极速免税店), xiaohongshu.com(小红书), yamtou.com(洋码头). Unlike brands in rank 1, brands in rank 2 sell a smaller variety of categories. You’ll usually find these platforms selling in the apparel, cosmetic, and other FMCG where they make the most money. Brands in rank 2 take up about 25.3% of the market share.

Rank 3

E-commerce brands in rank 3 take up the last 4.3% of the cross-border e-commerce market share in China. The brands in this group include baobeigezi.com(宝贝格子), mia.com(蜜芽), babytree.com(宝宝树). What you’ll find with rank 3 brands is they tend to be highly focused on a specific niche.

Due to popular demand, a huge population of China, and a general distrust of infant consumption industry. There are a tremendous opportunity and demand for healthy, clean, trustworthy, and reliable eCommerce brand that sells infant and kids related products. Not surprisingly, most of the rank 3 eCommerce brand will usually fit into this niche like mia.com.

B2C vs. C2C

When we take a close look at the history of cross-border e-commerce in China, what you’ll realize is that in the early year many of the cross-border e-commerce such as DaiGou or Bay all focused more on empowering the individual consumer to sell to another consumer.

However, as we move forward in time you begin to see more B2C platforms taking over that of C2C platforms for the following reasons.

Change in Policies: As more regulations are created by the Chinese government, stricter laws and rules would narrow down the leeway for some of the C2C platforms to survive.

Competition and Merges: Due to the fierce competition and price wars many of the smaller C2C platforms were forced to merge with B2C giant in order to survive.

Demand for Higher Qualities: Due to the rapid growth of China’s economy. Many Chinse consumer is now emphasizing the importance of quality over price. And B2C platforms will generally have more capital for better quality products and customer service compare to C2C platforms.

Users, Customers, and Expectation

To put it into perspective, in 2016, it is reported that there are more than 42 million Chinese consumers who are actively making purchases on cross-border e-commerce platforms, which is an 82.6% year over year(YoY) growth.

While it is hard to pin point the exact reasons of this phenomenon growth, but some of the obvious contributing factors can be the growth of the internet usage in China, the overall improvement in logistics for e-commerce shipping, change in Chinese regulations with regards to foreign goods, and the fierce competition between platforms that forces enhancement of overall user experience and trust.